Each year, the Social Security Administration (SSA) makes key adjustments, and understanding them is essential for effective budgeting. This guide from National Disability Benefits is your resource for the 2025 changes. We will break down the official Cost-of-Living Adjustment (COLA), review the new payment amounts for SSDI and SSI, detail updated income limits for working beneficiaries, and outline the disability payment schedule in 2025. Our goal is to provide the clear information you need to navigate the year ahead confidently.

A Deeper Dive into the 2.5% COLA for 2025

The Cost-of-Living Adjustment (COLA) for 2025 is a 2.5% increase, which was confirmed by the SSA in late 2024. But what does this really mean? The COLA is an essential feature of Social Security, designed to protect the purchasing power of your benefits from being eroded by inflation.

The SSA calculates this adjustment by tracking inflation using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). They compare the average CPI-W from the third quarter (July, August, September) of the current year to the same period in the previous year. The resulting percentage increase becomes the COLA for the following year. This 2.5% adjustment for 2025, while lower than the recent historic highs seen during periods of intense inflation (like the 8.7% in 2023), represents a continued effort to align benefits with the cost of everyday goods and services.

What This Means in Practical Terms

This increase was applied automatically to your benefits beginning in January 2025. You do not need to take any action to receive it.

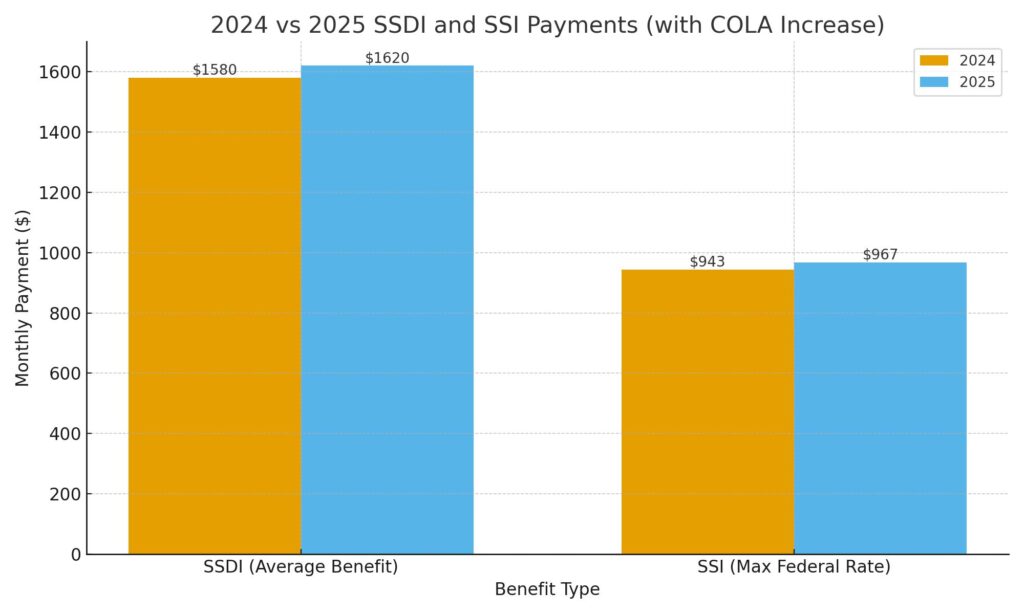

For an SSDI recipient receiving the projected 2025 average of $1,580, the 2.5% COLA means an increase of approximately $39.50 per month.

For an SSI individual receiving the maximum federal rate, the payment will increase from $943 in 2024 to $967 in 2025, an increase of $24.

First, The Basics: Are You on SSDI or SSI?

Understanding which disability program you are enrolled in is the first step to understanding your benefits. While both are managed by the SSA, their eligibility requirements and payment structures are fundamentally different.

Social Security Disability Insurance (SSDI): An Earned Benefit

Think of SSDI as an insurance policy. During your working years, you paid “premiums” through FICA taxes deducted from your paycheck. These taxes earn you “work credits.” To be eligible for SSDI, you must have accumulated enough work credits, a number that depends on your age when your disability began. Typically, an individual needs 40 credits, with 20 of them earned in the 10 years immediately preceding the disability. However, younger workers may qualify with fewer credits. Because it is an earned insurance benefit, SSDI payments are not affected by your current assets or unearned income.

Supplemental Security Income (SSI): A Needs-Based Program

SSI, on the other hand, is not based on your work history. It is a federal assistance program designed to provide a financial safety net for aged, blind, or disabled individuals with very limited financial means. To qualify, you must meet strict limits on your income and resources. “Resources” include things you own, like cash, bank accounts, stocks, and property (excluding your primary home and one vehicle). In 2025, the resource limits remain $2,000 for an individual and $3,000 for a couple. Because it is needs-based, SSI eligibility often qualifies an individual for other vital programs, such as Medicaid and the Supplemental Nutrition Assistance Program (SNAP).

Concurrent Benefits

It is possible to receive both SSDI and SSI simultaneously. This typically occurs when a person is eligible for SSDI but their monthly payment is very low (due to a limited work history or low past earnings). If their SSDI payment is less than the maximum SSI federal benefit rate and they meet the SSI resource limits, they can receive an SSI payment to supplement their SSDI check, bringing their total monthly income up to the SSI standard.

A Look at SSDI Payments in 2025

A common misconception about SSDI is that there is a single, standard payment amount. In reality, your SSDI benefit is entirely unique to your earnings record. The SSA uses a complex formula to calculate your Primary Insurance Amount (PIA), which is based on your Average Indexed Monthly Earnings (AIME). This process involves reviewing up to 35 of your highest-earning years, adjusting them for national wage growth over time, and then applying a progressive formula to the average. This formula is weighted to provide a higher percentage of replacement income for lower-wage earners.

2025 SSDI Monthly Payment Projections

| Payment Category | Projected Monthly Amount | Key Details |

|---|---|---|

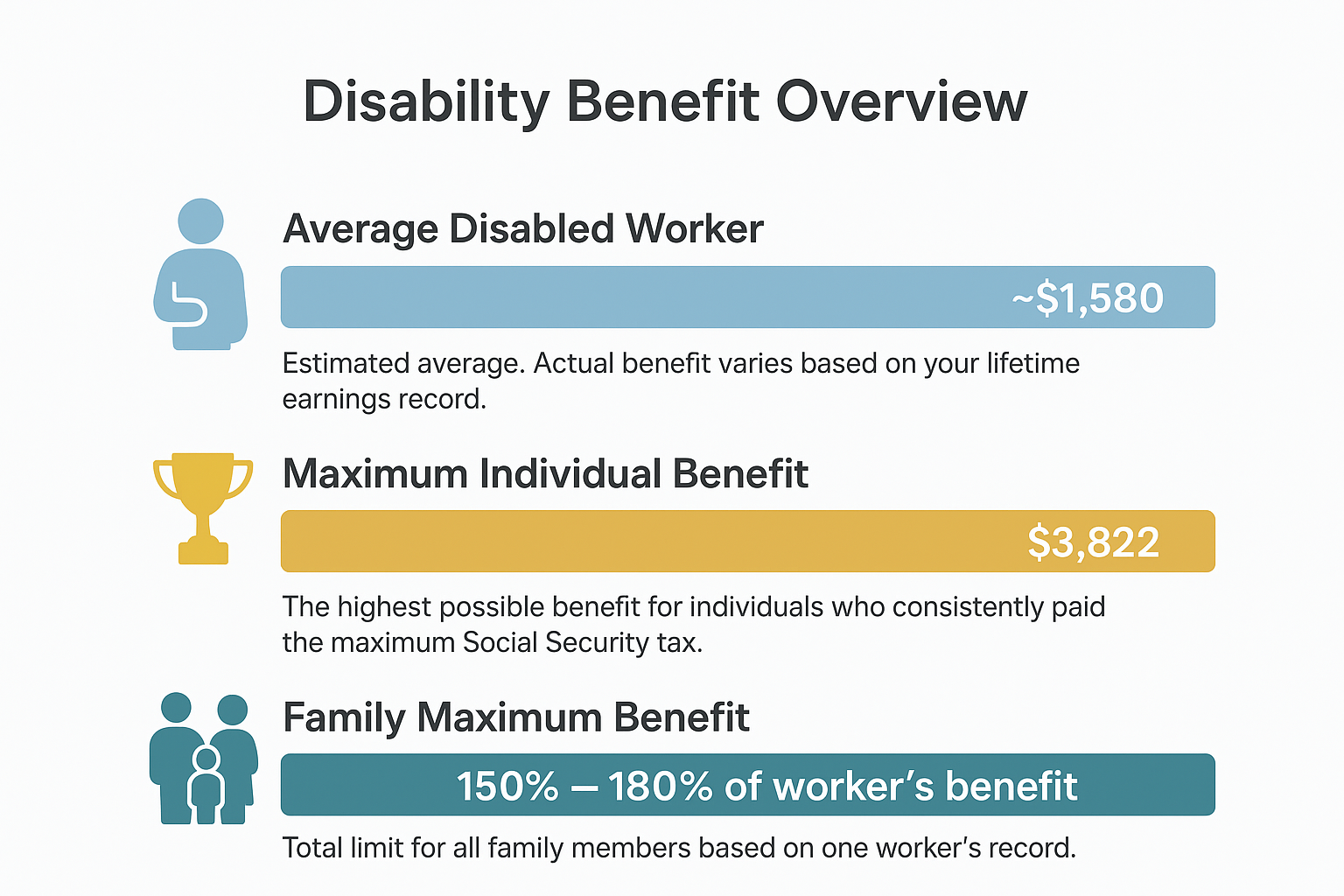

| Average Disabled Worker | ~$1,580 | This is an estimated average. Your actual benefit is based on your unique lifetime earnings record. |

| Maximum Individual Benefit | $3,822 | This is the highest possible benefit, reserved for individuals who have consistently paid the maximum Social Security tax throughout their career. |

| Family Maximum Benefit | 150% – 180% of the worker’s benefit | This is the total limit on benefits that can be paid to a family (worker, spouse, children) based on a single worker’s record. |

SSI Pay in 2025: The Federal Benefit Rate

Calculating SSI payments is more straightforward. It begins with the maximum federal benefit rate (FBR), which is the same for everyone nationwide, and is then reduced by any “countable income.”

The 2025 maximum Federal Benefit Rates are:

Individual: $967 per month.

Eligible Couple (both spouses eligible): $1,450 per month.

Understanding “Countable Income”

The SSA does not count all of your income when calculating your SSI payment. They apply several important exclusions. For instance, the first $20 of most income (earned or unearned) is not counted. For earned income from a job, the first $65 is also excluded, and after that, only half of the remaining earnings are counted.

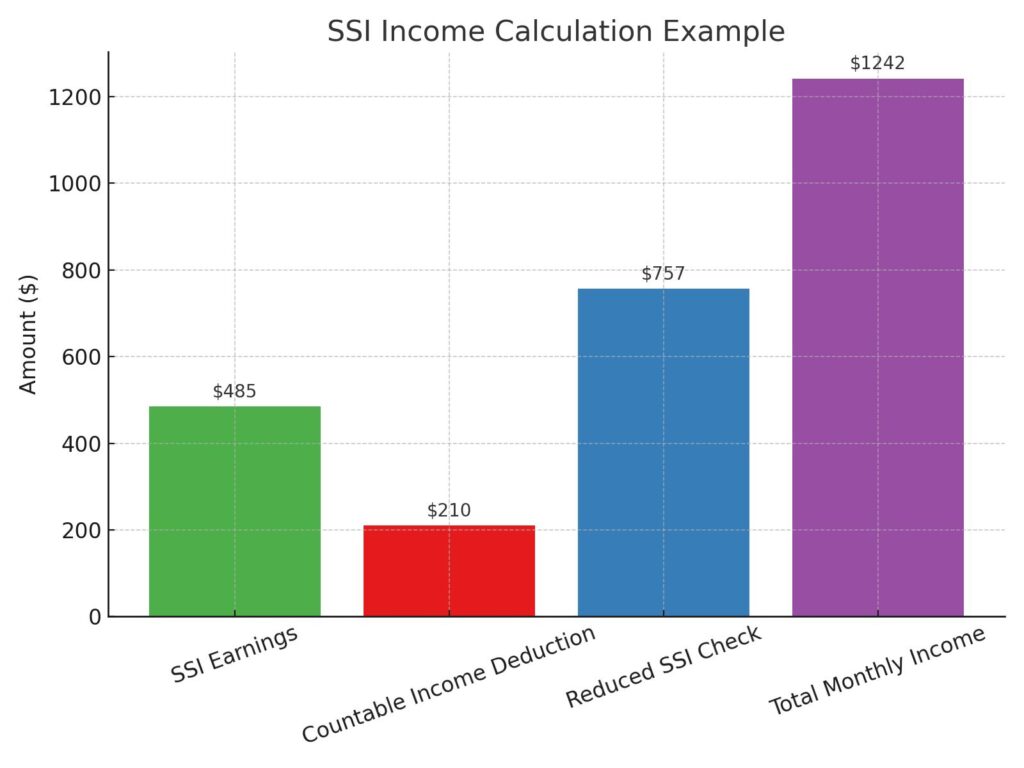

Example: An individual on SSI works a part-time job and earns $485 in a month.

1. The SSA ignores the first $65: $485 – $65 = $420.

2. They then count half of the remainder: $420 / 2 = $210.

3. This $210 is the “countable income.”

4. Their SSI check would be reduced by this amount: $967 (FBR) – $210 = $757.

The individual would receive a $757 SSI check plus their $485 in earnings for a total income of $1,242 that month.

Working While on Disability: 2025 Income Limits

The SSA provides work incentives to encourage beneficiaries who are able to return to the workforce. These programs allow you to test your ability to work without immediately losing your crucial medical and financial benefits.

Substantial Gainful Activity (SGA): The Earnings Ceiling

SGA refers to a level of monthly earnings that the SSA considers sufficient to demonstrate the ability to work and support oneself. Earning over the SGA limit from work (this does not include investment or other passive income) for a sustained period can lead the SSA to determine that you are no longer medically disabled.

2025 SGA Limit (Non-Blind Individuals): $1,620 per month.

2025 SGA Limit (Statutorily Blind Individuals): $2,700 per month.

It’s important to note that you can deduct the cost of Impairment-Related Work Expenses (IRWEs) from your earnings when the SSA calculates SGA. These are out-of-pocket costs for items or services you need specifically to be able to work, such as specialized equipment or transportation.

Trial Work Period (TWP): A Safety Net for SSDI Recipients

The TWP is a powerful work incentive available only to SSDI recipients. It allows you to earn an unlimited amount of money for up to 9 months without your earnings affecting your benefits. These 9 months do not have to be consecutive and can be used over a rolling 60-month period.

2025 TWP Threshold: A month counts as a trial work month if you earn more than $1,160.

Once you have used all 9 TWP months, you enter an Extended Period of Eligibility, during which the SGA rules will apply.

Understanding Deductions and Reductions

After your benefit amount is calculated, several factors can reduce the final amount you receive in your bank account.

- Medicare Premiums: Most SSDI recipients are automatically enrolled in Medicare after a 24-month waiting period. The standard Medicare Part B premium, which covers doctor visits and outpatient services, is usually deducted directly from your monthly SSDI payment.

- Benefit Offsets: If you receive other public disability benefits, like state workers’ compensation, your SSDI payment may be reduced. This offset is designed to prevent the total combined public benefits from exceeding a certain percentage of your pre-disability earnings.

- Garnishments: While Social Security benefits are protected from most private creditors, they can be garnished to enforce legal obligations for child support, alimony, or to repay debts owed to the federal government, such as back taxes.

When Will You Get Paid? The 2025 Payment Schedule

| Benefit Type / Recipient Group | Payment Date(s) |

|---|---|

| Supplemental Security Income (SSI) Only | 1st of each month |

| SSDI Only (Birth Date: 1st – 10th of any month) | Second Wednesday of each month |

| SSDI Only (Birth Date: 11th – 20th of any month) | Third Wednesday of each month |

| SSDI Only (Birth Date: 21st – 31st of any month) | Fourth Wednesday of each month |

| Concurrent Beneficiaries (Receive both SSI & SSDI) | SSI payment on the 1st; SSDI payment on the 3rd of each month |

Note: If a payment date falls on a weekend or a federal holiday, the payment will be issued on the preceding business day.

Contact National Disability Benefits for more information about the disability payment schedule in 2025

The dedicated advocates at National Disability Benefits are experts in this field. We can help you understand your benefits, ensure you are receiving the correct amount, and provide representation if you are just beginning your disability claim. Contact us today for a free, no-obligation consultation to get the clear answers and professional support you deserve.