A long-term disability can cause overwhelming financial strain. The Social Security Administration’s (SSA) disability program provides a vital lifeline, but its rules are complex. This 2025 guide from National Disability Benefits will answer all your essential questions about eligibility and payment amounts. We’ll explain how your Social Security disability benefits are calculated and offer a clear roadmap to securing the support you deserve.

The Two Pillars of Social Security Disability: SSDI and SSI

The first step in understanding your potential benefits is to identify which of the two main SSA programs you might qualify for. While both are designed to support individuals with disabilities, their eligibility requirements are fundamentally different.

- Social Security Disability Insurance (SSDI): The Program You’ve Paid For

SSDI is an earned benefit that functions much like an insurance policy. Through FICA taxes deducted from their paychecks, workers pay premiums into the system. To be eligible, an applicant must have a significant work history and have earned enough “work credits.” In 2025, individuals earn one credit for every $1,810 in wages, up to a maximum of four credits per year.

Generally, a person needs 40 credits to qualify, with 20 of those earned in the 10 years just before their disability began. This “recent work” test can vary based on an applicant’s age, with younger workers requiring fewer credits. Once an individual meets the work requirements and the SSA’s medical criteria for disability, they can receive benefits. These benefits may also extend to certain family members, such as a spouse or dependent children.

- Supplemental Security Income (SSI): A Needs-Based Safety Net

In contrast, SSI is not based on your work history. It is a federal program funded by general tax revenues designed to assist disabled, blind, and aged individuals who have very limited income and financial resources. To qualify for SSI, you must meet the same stringent medical definition of disability as for SSDI, but you must also pass a financial means test. The SSA will look at your income (wages, pensions, etc.) and your resources (cash, bank accounts, stocks, property). In 2025, an individual cannot have more than $2,000 in countable resources, and a couple cannot have more than $3,000. This program ensures a baseline of support for some of society’s most vulnerable members.

How Your Social Security Disability Payment is Calculated

One of the most common questions we hear is, “How is my Social Security payment calculated?”

For SSDI recipients, the amount is not based on the severity of your disability but on your average lifetime earnings before your disability began.

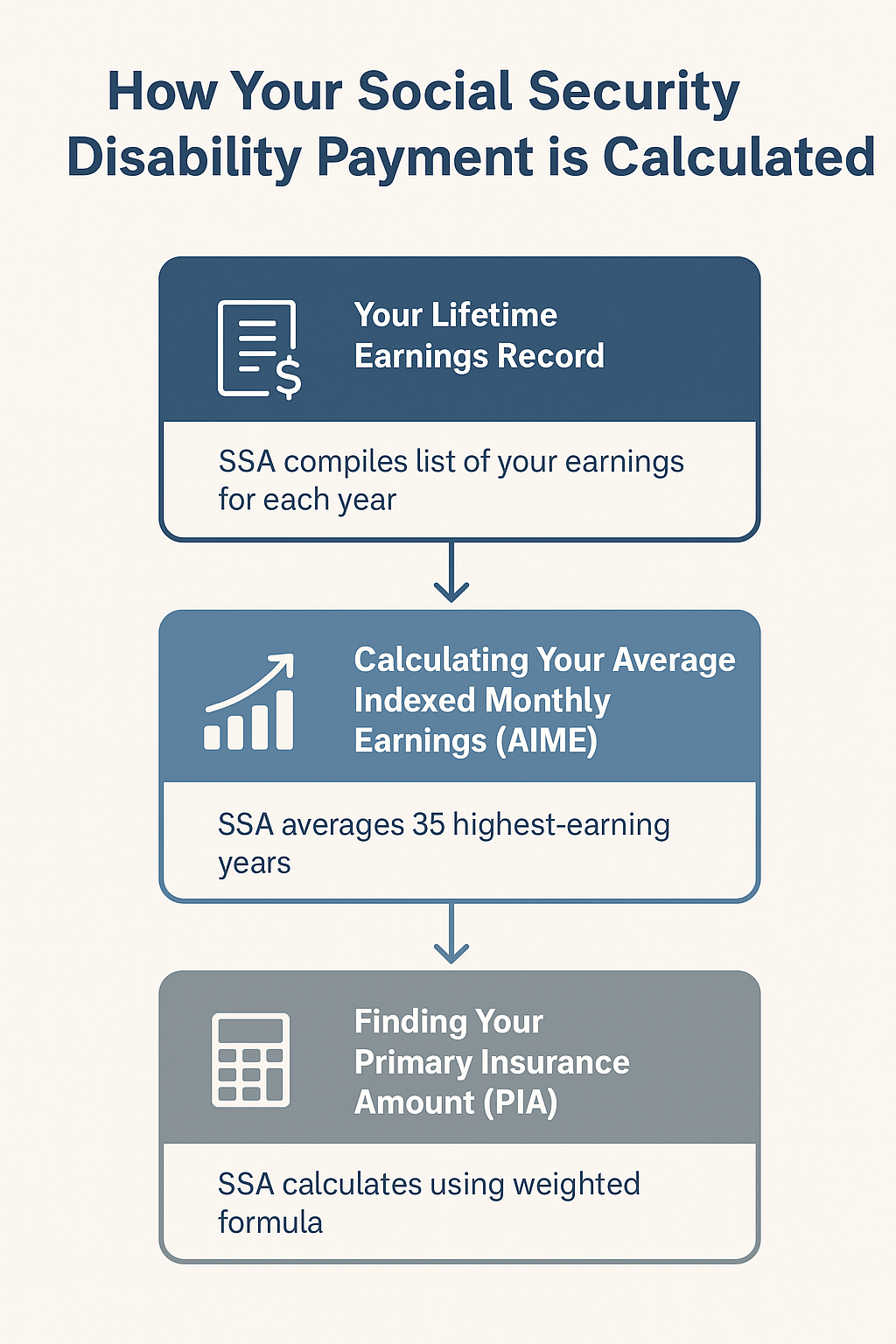

The SSA uses a complex, multi-step process to determine your unique benefit amount.

- Your Lifetime Earnings Record: The SSA first compiles a list of your earnings for every year you’ve worked, adjusting, or “indexing,” them to account for the general rise in wages over time. This ensures that earnings from decades ago are valued appropriately in today’s dollars.

- Calculating Your Average Indexed Monthly Earnings (AIME): From your indexed earnings history, the SSA selects your 35 highest-earning years and averages them to find your AIME. If you have fewer than 35 years of earnings, zeros will be used for the missing years, which can lower the average.

- Finding Your Primary Insurance Amount (PIA): Your AIME is then plugged into a weighted formula to calculate your Primary Insurance Amount (PIA), which forms the base for your monthly benefit. The formula is progressive, meaning it provides a higher percentage of income replacement for lower-wage earners. For 2025, the formula uses three tiers, or “bend points”:

- You receive 90% of the first $1,226 of your AIME.

- You receive 32% of your AIME between $1,227 and $7,391.

- You receive 15% of any AIME amount over $7,391.

The total of these three figures is your monthly SSDI payment. This formula ensures that your benefits are a direct reflection of your contributions to the Social Security system throughout your working life.

From Averages to Your Actuals: How Much Can You Receive?

It’s easy to find news headlines about the “average” disability payment, but this number can be misleading. Your payment is unique to you. Here’s what you need to know about benefit amounts in 2025.

- The National Average SSDI Payment: For 2025, the estimated average monthly SSDI benefit is around $1,580. This is simply a midpoint; a significant number of beneficiaries receive amounts both higher and lower than this figure.

- The Maximum SSDI Benefit: The highest possible monthly SSDI payment in 2025 is $4,018. This maximum benefit is reserved for individuals who have consistently earned the maximum taxable income (set by the SSA each year) over their 35 highest-earning years.

- Factors That Can Adjust Your Payment: Your base PIA is not always the final amount you receive. Certain factors can increase or decrease your family’s total benefit. For instance, if you receive workers’ compensation or other public disability benefits, your SSDI payment may be reduced through a process called a Public Disability Offset.

Navigating the Application Process and Securing Your Financial Future

Knowing how benefits are calculated is only half the battle. The application and approval process is notoriously difficult, with a majority of initial claims being denied. Building a strong case from the outset is paramount.

This involves much more than simply stating your diagnosis. You must provide extensive medical evidence, including clinical notes, lab results, imaging scans, and detailed statements from your treating physicians that clearly document your functional limitations and how they prevent you from working. The SSA will assess whether you can perform any of your past work or adjust to any other type of work that exists in the national economy.

If your initial application is denied, do not be discouraged. You have the right to appeal, a multi-stage process that includes reconsideration, a hearing before an Administrative Law Judge (ALJ), and potentially review by the Appeals Council and Federal Court. This is where expert guidance becomes invaluable, as navigating these legal channels requires deep knowledge of SSA regulations and procedures.

Contact National Disability Benefits for more information about obtaining your Social Security disability benefits!

Our team of skilled professionals understands the system inside and out. We can help you build the strongest possible application, ensure all your documentation is in order, and represent you through every stage of the process.

Contact us today for a free, no-obligation consultation to learn how we can help you achieve financial stability and peace of mind.