Americans who deal with disabilities have multiple options for assistance available. One of the most popular sources of disability support is the Social Security Disability Income (SSDI). The Social Security Administration (SSA) is responsible for this support opportunity. However, many participants may be missing out on a lot of money that they can receive from SSDI. They might be eligible for back pay with no clue about what it is or how it works.

If you look at the SSA’s sources of information, you will find that back pay benefits are officially called “past-due benefits.” Regardless, both names refer to the same thing, which is the time when you were eligible to receive your disability benefits but your application was still pending.

What is SSDI Back Pay? And How Does it Work?

Applying for SSDI and getting approval are two different events that most likely have two different dates. However, the moment you first applied for benefits could be the beginning of your rightful back payments. Look at this example to see how it all comes together:

- On November 20, 2021, you were told that you couldn’t return to work due to significant muscular dystrophy. This date marks the day you first got your disability which the SSA calls “the onset date.”

- Then you applied for SSDI on December 1, 2021, but your application was turned down.

- After that, you filed an appeal, so you got the opportunity to have a hearing before an administrative law judge. Your chances of winning the case are higher if you provide strong evidence to the judge at the hearing.

- November of 2021 would be the official date of when you started dealing with your disability if the court ruled in your favor.

- It usually takes five months before an individual can begin receiving SSDI benefits. Considering that your onset date is in November 2021, this means that you should start receiving benefits in May 2022, the sixth month after the onset date. However, accounting for the appeal process, it can be longer!

Let’s say you have been dealing with your disability for 15 months, from November 2021 to March 2023. However, you haven’t received any money this whole period. This is where SSDI back pay saves the day! In this case, SSDI’s back pay will compensate you for ten months of unpaid benefits (from May 2022 to March 2023).

What Does the Process Look Like?

Generally, the SSA calculates your SSDI benefit based on your previous income and employment history. In most cases, the SSA will issue a single lump-sum payment within 60 days of an approved SSDI claim to cover any back payments that may have built up.

It’s worth noting that the fee arrangement with your legal representatives, such as a lawyer or advocate, must first receive the SSA’s approval. People generally use these professionals during the appeal process. This cost, however, is capped at the smaller of $7,200 or 25% of the back pay amount. The SSA will deduct the cost of your lawyer from any back pay benefits if you hire one during the disability appeals procedure. Let’s say you receive a $1,000 benefit every month from the SSA. Using the same scenario as before, you would have to pay around $2,500 of the $10,000 in back pay to your attorney.

Another Source of Back Pay

You might think that the only way to get back pay is through SSDI, but that’s not true. Besides SSDI, you may also be eligible for back pay from Supplemental Security Income (SSI). However, it’s important to keep in mind that the rules for SSI back pay are slightly different from those for SSDI. Generally speaking, if you are low-income and meet other criteria, you may be eligible for SSI, which is a form of government assistance available through the SSA.

In general, the way of determining SSI back payments is different from SSDI payments. Unlike SSDI, which has a five-month waiting period, SSI’s back payments can be received immediately. In the case of SSDI, back payments begin on the day of eligibility, but in the case of SSI, they start on the date of application.

Another thing to keep in mind is that if your total back pay exceeds the maximum SSI benefit, you will not receive a lump sum. Instead, you will receive your money over the course of three equal six-month periods. The SSA sets the maximum SSI benefit for individuals at $943 per month in 2024. However, when it comes to back pay, neither SSDI or SSI has a maximum limit, which is fantastic.

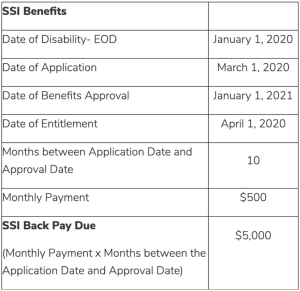

SSI Back Pay Example

As we mentioned before, back pay works differently for both SSI and SSDI. As per SSDI, you will start receiving payments five months after your onset date. Earlier in the article, we provided a scenario in which a recipient might be eligible for SSDI back pay. However, SSI considers your “date of entitlement.” This is the first day you are eligible to receive Social Security payments. To clarify, here’s an example of what it looks like when you get SSI back pay:

In Conclusion

It’s important to understand how back pay works because you may be due money and not know it. Some ways to receive back pay are either through SSDI or SSI. You should keep in mind that there are differences between both sources of back pay. However, neither of them has a maximum of how much back pay you can receive. Through back pay, recipients can get the funds they deserve. These funds can be especially helpful since recipients of either SSI or SSDI are going through some especially hard times. So, if you think you’re eligible for back pay, you should contact your lawyer. Another great place to get information is at the SSA. They can answer any questions and even provide resources when learning and dealing with back pay!